Artificial intelligence (AI) is no longer a futuristic concept confined to science fiction; it has firmly established itself as a transformative force across various industries, and the financial sector is no exception. Investment advisory services, traditionally built on the expertise and intuition of human advisors, are now seeing a seismic shift due to the integration of AI.

This technology automates complex processes and makes investment management more precise, accessible, and efficient. AI’s involvement is becoming so profound that companies like Unique Investment Advisors are adapting to leverage its capabilities to offer their clients more personalized, data-driven strategies.

The influence of AI in investment advisory services is reshaping the industry. It provides new tools for data analysis, risk assessment, and portfolio management, fundamentally changing financial decisions. Let’s explore how AI revolutionizes this domain and what it means for financial professionals and their clients.

AI in Data Analysis and Investment Strategies

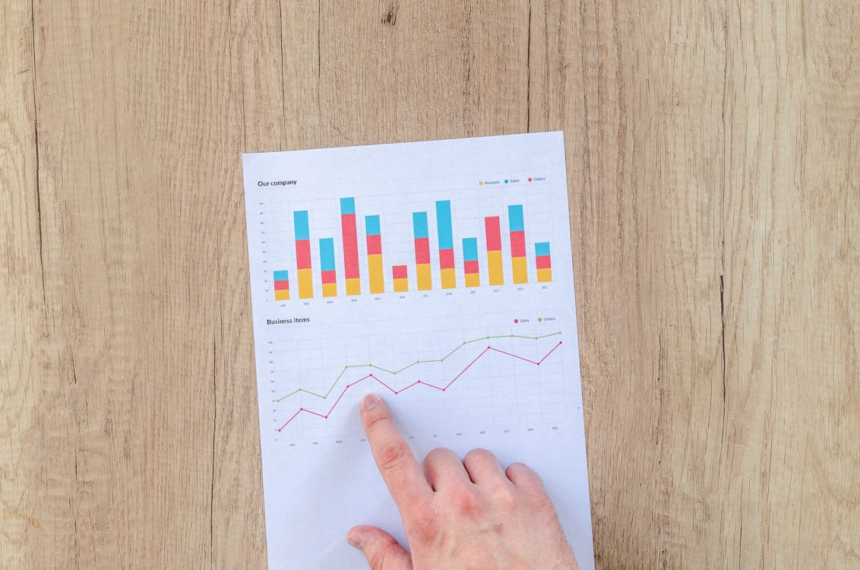

The one effect that stands out most in investment advisory services has been the analysis of data through the use of AI. Previously, financial advisors made their investment decisions using quantitative data and trends, assessed either by hand or using simple models. However, AI has taken this to the next level by making real-time, dynamic data analysis possible and highly efficient.

Machine learning algorithms can process financial data gathered from various sources, including stock prices, economic indicators, social media sentiment, and geopolitical news. These AI systems can recognize patterns, correlations, and outliers that would be extremely difficult for a human advisor to identify independently. This data processing capability allows AI to predict market trends and potential investment opportunities more accurately.

For example, an AI system can analyze current market trends and suggest investment opportunities in less than 15 minutes, while it will take the human advisor much longer to do the same. This capability enables investment firms to be more responsive to market changes and thus provide better solutions to their clients. In this context, AI is a perfect fit to help investors outcompete rivals and secure the most attractive investment opportunities.

Investment Planning Using Artificial Intelligence

The fourth area that is seeing tremendous change due to the deployment of AI is the provision of customized investment advice. In the past, investment advisors have relied on interviews with clients, analysis of their financial statements, and risk analysis to develop the right financial plan. However, this process is usually lengthy and may not always consider slight changes in a client’s cash position or changes in the market.

AI, especially in the form of robo-advisors, is changing this. These AI systems use algorithms to evaluate a client’s risk appetite, investment objectives, and time horizon to provide them with a portfolio developed to suit the client’s needs. The ability to update makes AI-based individualized planning unique and innovative. Suppose market conditions change or the client experiences a change in financial status. In that case, the AI systems can also change the investment strategies to keep a portfolio aligned with the client’s objectives.

However, AI aids not only in the design of investment strategies but also in their management. Portfolio rebalancing—periodically restoring the investment portfolio’s risk profile to a target level—remains fundamental to long-term investment management. AI-driven platforms perform this process, which analyzes portfolios and makes real-time changes without human beings’ involvement. These constant checks and readjustments make it possible to be more accurate when it comes to investment handling, something that would not be easily possible in traditional advisory services only.

Enhancing Accessibility and Reducing Cost

Another positive impact of AI in investment advisory services is that it brings what was once complex financial planning to everyone’s reach. Traditionally, investment advisory services were essentially a preserve of the affluent who could afford to pay for professional advice. However, the use of AI in investment advisory services has enabled firms to reduce the cost of advisory services while maintaining the quality of the advice given.

Thanks to AI and robo-advisors that have emerged on the market, people with relatively small amounts of money can also get highly effective investment consultation that will be as individual as those with a large amount of money. Such AI-driven platforms can provide services at a significantly lower price than traditional advisors; hence, people who couldn’t afford professional advice before can get it.

For firms like Unique Investment Advisors, this means that they can reach more people with their services while still providing the highest-quality service that their clients desire. The presence of human supervision and AI-driven automation enables such firms to serve different clients, including novice investors and experienced financiers, with the necessary tools to navigate the market.

The Future of AI in Investment Advisory Services

It is vital to note that AI has already started to transform the investment advisory services market. However, the potential of this technology still needs to be explored. Future improvements in AI will introduce more advanced means of portfolio management, risk evaluation, and customized financial planning. These advancements will improve the efficacy of investment strategies and introduce new possibilities for both the advisor and the client.

However, as with every phenomenon, AI has its problems. Thus, human supervision is still necessary to analyze AI results and make complex decisions that AI has yet to make. The most effective investment advisory services incorporate the use of AI with human knowledge and skills.

In conclusion, the use of AI in the investment advisory industry is revolutionizing the current and future possibilities of how data is collected and processed, how investment strategies can be adapted to the individual, and decreasing the cost of access to quality financial advice. As more and more companies such as Unique Investment Advisors incorporate AI into their services, the future of investment management is exciting and progressive, allowing clients to work with human specialists and artificial intelligence.