Are you considering a home equity line of credit to fund your home improvement plans, consolidate debt, or cover significant expenses? While this flexible financial tool offers numerous benefits, understanding the timeline for accessing your funds is essential. From the application process to the point where you can start using your line of credit, knowing what to expect can help you plan better. Let’s walk through the process to give you a clearer picture of how long it might take.

The Application Process

The first step in accessing a HELOC is applying. This involves providing personal and financial information, including income, credit score, and home equity. Most lenders also require documentation such as tax returns, pay stubs, and proof of property ownership.

Once your application is submitted, the lender will review your eligibility, verify your debt-to-income ratio and evaluate your home’s market value. Depending on the lender and the complexity of your financial situation, this step typically takes a few days to a couple of weeks. To streamline the process, ensure all your documents are accurate and readily available.

Home Appraisal and Underwriting

After reviewing your initial application, the lender may require a home appraisal to determine its current market value. This is a critical step, as the equity in your home determines how much credit you can access. The appraisal process can take about one to two weeks, depending on the availability of appraisers in your area.

Simultaneously, underwriting begins. During this stage, the lender thoroughly assesses your financial profile, verifying your creditworthiness and ability to repay the loan. This phase can take another week or two, but having a solid credit score and financial standing can expedite the process.

Approval and Final Paperwork

You’ll receive an official approval letter once underwriting is complete and the appraisal confirms your home’s value. At this stage, the lender will outline the terms of your HELOC, including the credit limit, interest rate, and repayment structure. Carefully review the terms to ensure they align with your financial goals.

After you accept the terms, you’ll be required to sign final paperwork. This includes a formal agreement and disclosure documents. Depending on your lender’s procedures, this step can take a few days to complete.

The Waiting Period Before Access

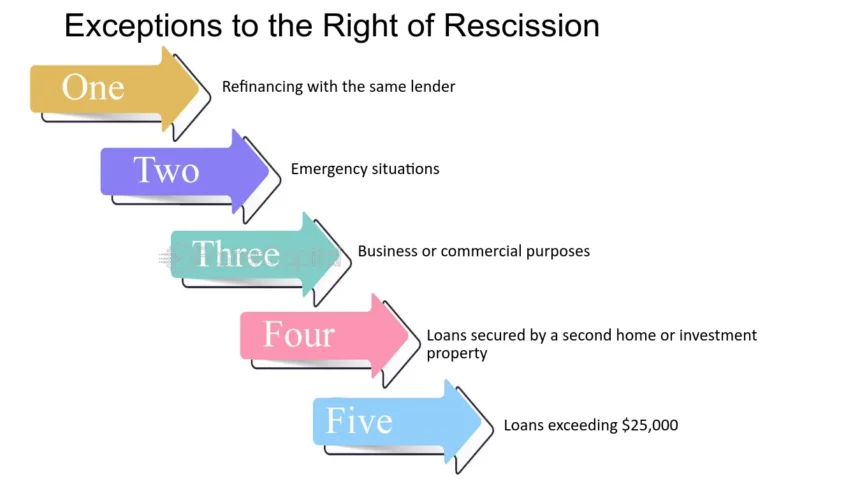

In many cases, there’s a mandatory waiting period after signing the final paperwork, often called the “right of rescission.” This typically lasts three business days and allows you to reconsider your decision. During this time, you can cancel the agreement without penalties.

After the waiting period ends, the lender will activate your line of credit, and you’ll gain access to the funds. This step is usually quick, with many borrowers receiving access within one to two business days.

How to Access Your Home Equity Line of Credit Funds?

Once your Home equity line of credit is active, you can use the funds as needed. Most lenders provide flexible credit line access options, such as checks, debit cards, or online transfers. The funds can be withdrawn in increments, allowing you to borrow only what you need for specific projects or expenses.

Using a Home equity line of credit responsibly can help you manage significant costs without depleting your savings. Partnering with a reliable provider like AmeriSave ensures you have the guidance and support needed throughout the process.

Understanding the timeline for accessing a Home equity line of credit helps you make effective financial decisions. By preparing your documents, knowing the steps involved, and working with a trusted lender, you can confidently enjoy the flexibility and benefits of a home equity line of credit.